Something many people cannot seem to wrap their heads around is the concept of cryptocurrencies – how are cryptocurrencies created? What makes them valuable?

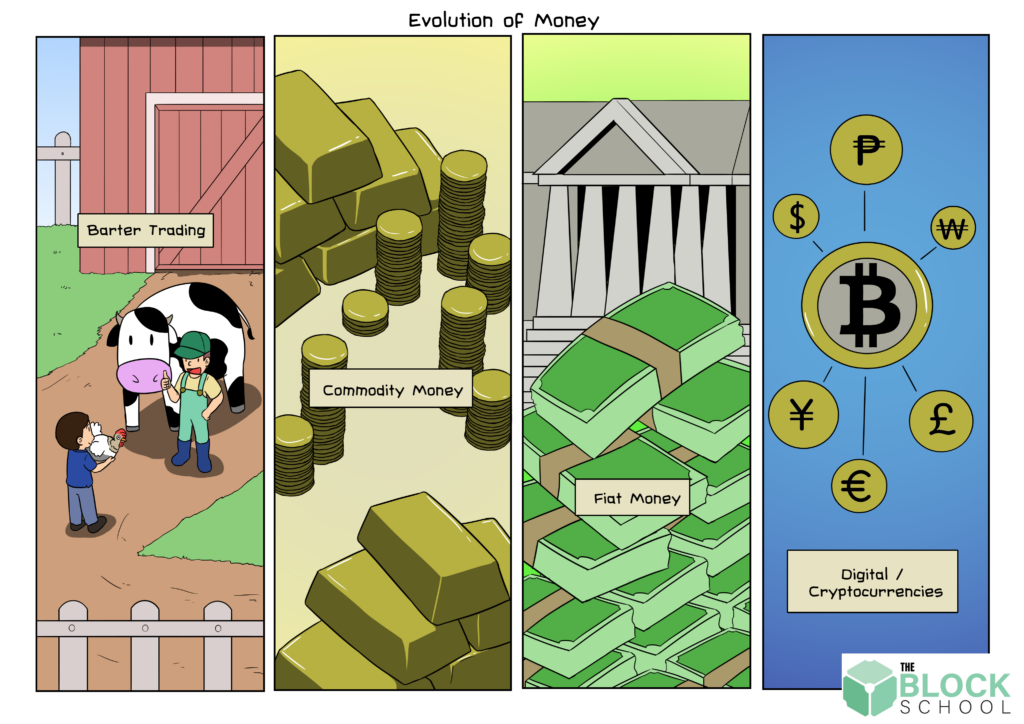

To understand this, let’s take a brief look back at the history of money.

A cow for 100 cowrie shells?

It all started with barter trading in the past, where people transfer value through direct exchange of goods and services with each other. With the growth of civilisation and rise of the institution, we see the transition from the barter system to the monetary system.

Here, value is not transferred directly but rather through a medium of exchange. Fiat money, for example, marks the shift to a centralised legal tender backed by institutions such as the bank or the government.

Digital payment revolution

The rise of the digital age and globalisation has brought about the online payment revolution, with more technological disruptions being witnessed in the last 10 years than the previous 35 years in the payment landscape. We see the shift to a cashless system with the wide array of digital payment options and infrastructure available – from debit and credit cards payment, internet banking (iBanking), Society for Worldwide Interbank Financial Telecommunication (SWIFT) system to mobile payment wallets.

Growth for the eCommerce industry has also been promising with an anticipated 276.9% increase in worldwide eCommerce sales from 2014 to 2021. This has led to an accelerated demand for the cashless system while physical money is on the decline, paving the way for digital currencies to take on a much larger role in the global economy.

Emerging technology – artificial intelligence (AI) and the internet of things (IoT)

Technological advancements in the areas of AI and IoT have also expedited the fintech revolution, expanding ways in which payment could be made. It has enabled the growth of contactless payments on phones and wearables such as WeChat Pay on leading mobile chat, Wechat and Apple Pay, Apple’s popular payment solution which is also accessible on its smartwatch. Through AI, Amazon has envisioned to create a more ‘naturalistic’ payments journey via innovations such as its Echo smart speaker which allows customers to make purchases online via voice command.

Money is nothing but a form of social construct

As history shows, there is no intrinsic value of money. Rather, money is a form of social construct – where the value is set by the masses and determined through a shared consensus. Money has evolved through the ages, based on societal needs and demand at any point in time.

Cryptocurrencies – the next frontier?

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”

Was the secret message imbued within Bitcoin’s Genesis Block raw data. It alluded to the headline in January 3rd, 2009 edition of The Times, a London-based newspaper, which reported the British government’s failure to stimulate the economy following the 2008 financial crisis.

Satoshi’s deliberate effort to include this message in the genesis block speaks to his ultimate mission with cryptocurrency and rejection of the centralized fiat system. Cryptocurrencies, as decentralised currencies where every transaction can be traced on a distributed digital ledger, can thus be seen as fighting against money being created out of thin air rather than being money created out of thin air.

Backed by the decentralised and distributed nature of blockchain technology, cryptocurrencies could offer a much more reliable and powerful transaction method that could disrupt traditional payment infrastructure.

Enabling quick, transparent and traceable payment like never before

Fundamental to the current payment ecosystem is the trust users have to place in the governing body, such as banks or payment systems. Often, users have no way of tracking their transactions and have to wait days for cross-border transactions to pass through.

Although current payment solutions such as SWIFT network which enables banks to send money to one another have helped improve issues surrounding transaction speed and traceability, there are still limitations to this system. For one, SWIFT is a closed network which only member banks can utilise. As a centralised network, SWIFT is also susceptible to breaches – just last year, Banco de Chile, Chile’s second-largest bank lost about $10 million due to fraudulent SWIFT wire transfers while the theft of more than $100 million via fraudulent SWIFT transfers has been linked to a North Korea hacker gang.

On the other hand, Blockchain technology with its decentralised and distributed nature has the added advantages of ensuring inclusivity and security with its permissionless distributed ledger accessible by any and everyone. With data no longer held by a centralised body but instead held by every individual node, blockchain technology has democratised trust.

More than just money

Through the use of cryptography, a form of data encryption, cryptocurrencies have birthed a new class of money – programmable money. Novel cryptography protocols have enabled cryptocurrencies to go beyond their role as merely a medium of exchange, enabling them to further value add to the current payment ecosystem.

Bitcoin first brought peer-to-peer transactions to the people while Ethereum, another cryptocurrency has introduced the next generation platform touted as the “world’s computer”. Smart contracts, a transaction protocol developed for automated proofing and execution of conditions of a contract between different parties is an example of a powerful feature enabled by blockchain technology. It shifts the control from an unreliable central body to the system of codes where transactions are immutable and irrevocable, helping to improve security and preventing fraud in transactions.

Making waves in the payments landscape

The adoption rate of cryptocurrencies as an alternative payment method has also been gaining traction in the past few years. Notable mainstream companies have adopted the use of cryptocurrencies such as Samsung integrating a cryptocurrency wallet for its flagship phone, the Galaxy S10 and supporting four decentralized apps (dApps) at launch. Korea’s biggest messaging application Kakao is also offering a crypto wallet for 44 million users. Cryptocurrency payment service providers such as Bitpay and Coingate have also help speed up the adoption of cryptocurrencies as a payment method by offering companies a simple and seamless integration solution. For example, Bitpay has partnered with popular mainstream companies such as Microsoft, Shopify and Virgin Galactic to support selected cryptocurrencies as a payment method on their platform.

A Deloitte study has estimated a 40% to 80% reduction in transaction costs business-to-business and person-to-person payments with blockchain, and a reduction of transaction speed from two to three days to an average of four to six seconds. This further highlights the benefits of adopting this technology for the masses.

Other than just being a supplementary payment method, blockchain technology is also reinventing the payment ecosystem as the world’s first programmable money. By eliminating the middleman, blockchain technology has removed excessive silos while encouraging interoperability in the ecosystem. With the growing acceptance of cryptocurrencies, demand for cryptocurrency related infrastructure such as bitcoin ATMs, POS systems such as Pundi X and hardware wallets such as ledger wallets have also increased exponentially.

Despite growing acceptance, challenges still remain, with a recent survey by Kaspersky Labs suggesting that cryptocurrency-based payments are still one of the least popular methods for conducting online payments.

To succeed, blockchain technology needs to integrate and co-exist alongside the current payments infrastructure. Ultimately, adoption is still key – whether cryptocurrencies will become a prominent part of the payment ecosystem is still yet to be determined but the future does indeed look bright.